Looking for Louis Navellier reviews?

Welcome to my review of the newsletter writer and editor, Louis Navellier.

Louis Navellier is a growth investor who is always keeping an eye out for the latest market trends.

You may have come across one of his adverts on YouTube, Facebook, or any other website and are wondering whether you should be listening to him.

Here, I dissect his strategy, services and give my two cents on whether he is legit, so keep reading to get all the details.

Before I start…

If you’re tired of scams and want a real solution for making money online check out my no.1 recommendation.

It’s helped me earn over $300,000 in the last 12 months alone:

Go here to see my no.1 recommendation for making money online

(This is a 100% free training)

Louis Navellier Reviews

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Who Is Louis Navellier?

Louis Navellier is a growth investor with more than three decades’ experience in the financial services industry. During that period, he has been publishing independent investment advisory services to his followers and readers.

He is one of the most prolific gurus in America and from the track records of his services, it seems some people like his methods.

Growth investing, which he is best known for, is an investment approach whereby an investor focuses on young, promising companies whose growth is expected to increase at an above- average rate compared to comparable stocks in its industry or across the market. It is among the most popular investment strategies.

Navellier is a practitioner of growth investing and most of his research focuses on emerging companies that can earn him big returns in the long run. His work is best suited for growth stock investors.

Louis Navellier is confident that individual investors can earn more money if they focus on growth stocks.

He has followers numbering in the tens of thousands; these are people who have subscribed to his investment advisory services.

Louis Navellier’s Investment Strategy

Navellier is a stock picker, an investment adviser, and a qualified portfolio manager who focuses on picking high-performing and high-yielding stocks that can offer unprecedented results. He sometimes recommends blue chip growth stocks.

Louis believes in diversification. It is evident in the way he builds his portfolio as he picks high-performing companies from a wide range of sectors (and sub-sectors).

He has been known to employ a three-step stock selection process for analyzing market data that is built on fundamental analysis, quantitative analysis, and the optimization of the securities he selects for his portfolio.

He does this with the help of computer-based analytical systems that analyze market gyrations.

Throughout his 35-year investing career, his track record has been decent. He has worked with powerful market analysis tools that have beat the market and earned him and his followers decent profits.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Louis Navellier’s Education Background

Louis attended the School of Business & Economics at Cal State Hayword (which now goes by the name Cal State East Bay). He graduated at the age of 20 and got his B.S. in Finance a year later.

While he was in college, he took part in a research project whose goal was to mimic the S&P 500’s performance. As he was executing the project, he discovered ways of beating the market with a strategy that blended quantitative and fundamental analysis.

He claims to have beaten the market convincingly, earning the respect of his professor.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Work History

After graduating, Navellier started working in the financial services industry offering investment advice and trading professionally.

He began publishing a monthly newsletter targeting retail investors and in 1997, he struck a partnership with InvestorPlace Media, LLC to start publishing a newsletter that was basically a ratings system for blue chip growth companies. It was called The Blue Chip Growth Letter.

He launched a few other newsletters at InvestorPlace with the most popular one being Emerging Growth. This service was rated by The Hulbert Financial Digest as one of the top performers in a period stretching 20 years.

He claims to have outperformed the market in that period. The Hulbert Financial Digest was an independent ratings system that was discontinued.

Navellier founded (and chairs) a fund management company based in Reno, Nevada called Navellier & Associates.

He oversees a team of analysts and has over $2.5 billion in private accounts and no-load mutual funds for individual investors and institutional accounts. He also manages thousands of personal portfolios.

He insists that not only is the firm dedicated to picking the market’s best growth stocks but also it utilizes a disciplined quantitative cum fundamental analysis system so that individual investors can put their money in the best investments.

He was declared one of the best performing advisors by TheStockAdvisors.com, an independent entity that rates performance.

Navellier currently travels the country hosting seminars for individual investors and these are mainly meant to promote his advisory services.

Books

He published a book called The Little Book That Makes You Rich in 2007. It was one of the Top 10 Investing Books of 2007 according to SFO Magazine.

On its Amazon page, this excerpt from its description sums up Navellier’s approach:

” …he shows you how to find stocks that are poised for rapid price increases, regardless of overall stock market direction. Navellier also offers the statistical and quantitative measures needed to measure risk and reward along the path to profitable growth stock investing. Filled with in-depth insights and practical advice, The Little Book That Makes You Rich gives individual investors specific tools for selecting stocks based on the factors that years of research have proven to lead to growth stock profits. These factors include analysts’ moves, profit margins expansion, and rapid sales growth. In addition to offering you tips for not paying too much for growth, the author also addresses essential issues that every growth investor must be aware of, including which signs will tell you when it’s time to get rid of a stock and how to monitor a portfolio in order to maintain its overall quality.”

Media

Louis has appeared on many TV shows on Fox Business News and CNBC analyzing the latest stock market news.

What’s more, you may have encountered an article or two by him on publications like The Wall Street Journal, Bloomberg, and MarketWatch. His articles are widely published by InvestorPlace.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

What Newsletters Does He Offer?

Louis Navellier offers many premium investment advisory services and as we’ve seen, he also runs a money management firm where his modus operandi is to exploit major flaws and inefficiencies in the markets.

He publishes most of his newsletters and investment advisories via InvestorPlace where you can gain easy access to his insights through a monthly subscription.

Here are the advisories he currently publishes (as of writing this review):

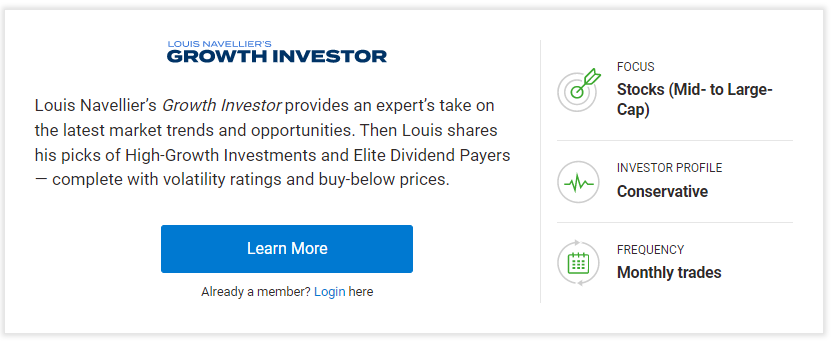

Louis Navellier’s Growth Investor

Louis Navellier’s Growth Investor service is arguably his most popular investment advisory service because it encapsulates what Louis Navellier’s core strategy entails. With the help of his research and editorial team, has been writing the publication for years.

As a member, Growth Investor exposes you to Louis Navellier’s experience and insights as well as the latest market trends worth paying attention to. You can read more about the newsletter by checking out my comprehensive Growth Investor Review here.

In addition to market trends, he also shares detailed updates on High-Growth Investment opportunities and Elite Dividend Payers (income stocks) alongside important stock market news.

Louis has a proprietary stock screening system that helps with the research for Growth Investor picks.

How much does the Growth Investor cost? Well, the price varies according to the plan you choose.

In most cases, Navellier is usually running a marketing campaign for it and the subscription fee is $49 if you choose Basic, $79 for Pro membership, and $99 for VIP membership.

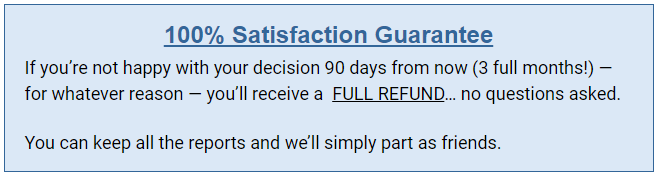

Growth Investor has a 90-day money-back guarantee as shown here on the order page:

If you intend to sign up for the newsletter, you should read the terms and conditions to ensure that the guarantee lasts for three months because they may change it without warning by the time you read this.

If you become a member of Growth Investor today, you will receive special reports covering different opportunities. A few examples from Louis Navellier’s research library include:

The Kings of Scalability: 3 Must-Own Stocks to BUY NOW

This report is about the next generation of highly scalable tech businesses (the most future proof companies).

It concerns companies that are growing faster than usual driven by technological advances. Since they have very low marginal costs, they make a lot of money in a short period and they don’t need many employees.

Navellier has his favorite business out of the lot and he has highlighted it in the report.

The Network Effect: The Most Powerful Wealth-Creation Force in History

Louis Navellier believes that you can only take advantage of exponential progress if you tap into “the network effect.”

He says that it is the “secret force” that turned fledging startups like Amazon, Facebook and Google into the behemoths they are now.

He says that there are small, innovative new technology companies using the power of the network effect in the present and he will share their full details in his special report.

Portfolio Destroyers: 10 Ticking Time Bombs to Sell Now

This report delineates the “doomed firms” you should remove from your portfolio because they will underperform or go bankrupt in the next few years.

The #1 Stock for the Driverless Car Revolution

When the Growth Investor team launched this newsletter, they wanted to inform us of the driverless car revolution.

They describe it as an unstoppable trend that will transform our lives.

Louis Navellier insists that after years of relative quiet, autonomous driving cars will enter the “lift-off” stage.

He wants you to position yourself to earn massive returns when this happens and this special report explains how you will achieve that.

The AI Revolution

Louis Navellier claims that early growth investors can make a fortune as AI adds $30 trillion in revenue to the global economy.

He says that the impact of the AI revolution will be huge and stocks related to Artificial Intelligence have immense potential.

This report has a list of firms that may lead this revolution.

Five Breakthrough Stocks That Could Soar an Extraordinary 5,000% or More

This report has five of Louis Navellier’s speculative stock picks. These companies are involved in markets like solar manufacturing, cyberoptics, and 5G.

The Inflation Survival Guide: Six Stocks to Buy As America Turns Socialist

Louis believes that the country will turn socialist and in this report, he writes about six stocks he feels could help you survive the ill effects of inflation.

Events Promoting Growth Investor

Whenever he hosts online events promoting this advisory service, he usually talks about massive changes to the global economy with statements like this one that I lifted from one of his recent pitches (Titled “I am a One Percenter”):

‘Welcome to the Technochasm.

And the rate of change is speeding up every year.

The destruction of certain industries is only going to get worse. Much worse. While the money being made by a select few is only going to be more dramatic.”

In this one, he was talking about the wonders of technology and how he harnesses it to find good investment ideas in a crowded market.

You’ll also see him throw in statements like (also from the same presentation)

“I recommended the young startups bringing the computing revolution into our homes…

I was one of the first to recommend a little-known company founded by two guys working out of a garage in California, called Apple, when it was just a $1.49 stock…

And a promising young company called Dell – that was revolutionizing the PC mail order business — when it was less than a buck…”

Louis Navellier’s Growth Investor is all about low-risk, high reward investment opportunities and mostly targets mid- and large-cap stocks.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

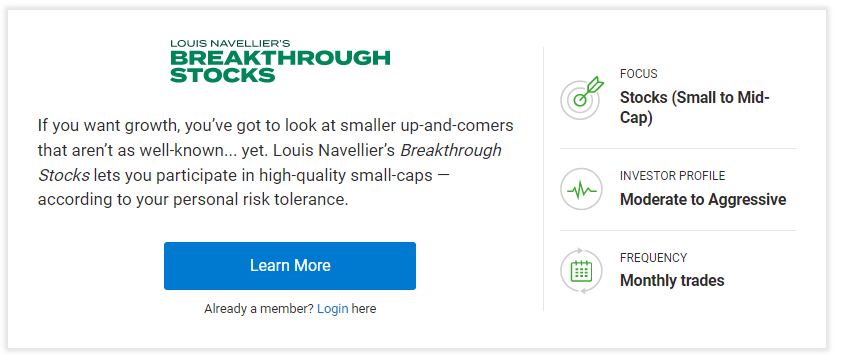

Breakthrough Stocks

With the Breakthrough Stocks service, you will mostly find smaller and little known up-and-comers of the market.

On the order page, they describe it thus:

On the order page, they describe it thus:

“You’re one of the lucky few who now has the chance to target big gains over the next year…

By using Louis Navellier’s revolutionary Quantum Scoring research to target small cap investments capable of doubling, tripling, even soaring 10x higher in just a few short years.

This is the same type of research that helped Louis’ research firm recommend Priceline when it was trading for $27 … Netflix at just $1.37 per share … and Apple when it was trading for just $1.49.”

The strategy here focuses on high-quality emerging growth small-cap stocks and gives you the flash alerts you might have otherwise overlooked.

How is Breakthrough Stocks Different to Growth Investor?

From that description it is apparent that there is an overlap between Breakthrough Stocks and Growth Investor because they focus on small-cap stocks and he gives the same examples (Apple, Facebook, etc) when explaining his track record.

He also claims to have spotted the potential of FAANG stocks before anyone else in America did it.

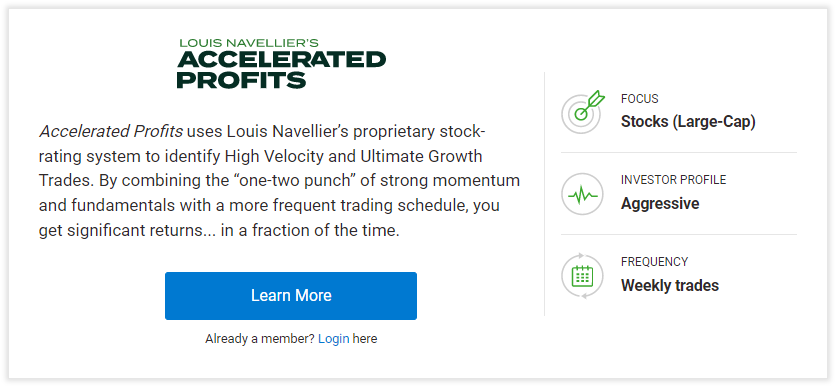

Accelerated Profits

Accelerated Profits focuses on a proprietary stock-rating system that lists High Velocity and Ultimate Growth Trades that are mostly large-cap stocks.

Here is an excerpt from a presentation Navellier did called “Project Mastermind” describing the advisory service:

Here is an excerpt from a presentation Navellier did called “Project Mastermind” describing the advisory service:

“Like I said, the goal of this whole project is to find the fastest-moving stocks on the market… stocks that could hand you massive gains in only a few months…

But as Project Mastermind continued to develop, the AI it uses continued to get “smarter” and started finding stocks that delivered big returns in only a few weeks…

I couldn’t believe it at first…

But it kept finding so many weekly winners, I began tracking them in Accelerated Profits.”

Once you become a member of this one, he will make stock recommendations that earn you quick returns, sometimes in a matter of weeks. He uses Artificial Intelligence to pick the companies.

Power Options

Louis Navellier’s Power Options publication is his foray into options trading.

He focuses on Long-Term Equity Anticipation Securities (LEAPS options). They are options with a longer expiry period than standard options.

He focuses on Long-Term Equity Anticipation Securities (LEAPS options). They are options with a longer expiry period than standard options.

He finds stocks that he is bullish on and recommends call options (LEAPS) on them. Louis says that investors of all experience levels can join, take his advice and invest in these kind of stocks.

Power Options is arguably the service that differs most compared to Growth Investor.

Platinum Growth Club

Platinum Growth Club is for investors that wish to gain access to all of Navellier’s investment newsletter services. If you are a member of more than one of his advisories, it is worth a try.

It combines all of his services; Growth Investor, Breakthrough Stocks, and Accelerated Profits. It can be seen as his VIP membership.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Is Louis Navellier Legit?

Yes he is legit.

He is an accomplished and well-known Wall Street insider who works as a newsletter editor with a team of more than 50 professional analysts and staff working for his money management firm, Navellier & Associates.

The team manages assets worth more than $2.5 billion. As someone who has decades of experience in this industry he is, at the very least, legit.

However, he is not faultless because in 2017, he was embroiled in controversy when the SEC, the leading regulator in America, charged Navellier for falsifying the firm’s track records in marketing materials, a charge that Navellier denies.

In 2020 the SEC gave their final judgement on the fraud charges costing Navellier & Associates over $30 million USD.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Verdict for Louis Navellier

Louis Navellier is an experienced investment analyst and newsletter editor.

You can trust his insights but you should bear in mind that most of his strategies are suitable for long-term investments, stocks you can buy and hold. His approach is suited to growth stock investors.

If you are considering becoming a member of one of his services, it really comes down to what your personal investment strategy is and the kind of investment opportunities you’re looking for.

He offers several services that focus on specific strategies that could be right for you, but ultimately it depends on individual approaches because while some people are investing for the long term, others are looking for short term gains.

Fortunately there are numerous experts out there and sometimes having a combination of newsletters from different gurus will help you build a diversified portfolio. Of course you should always do your due diligence.

Before you leave

If you’re tired of scams and want a real solution for making money online check out my no.1 recommendation.

It’s helped me earn over $300,000 in the last 12 months alone:

Go here to see my no.1 recommendation for making money online

(This is a 100% free training)